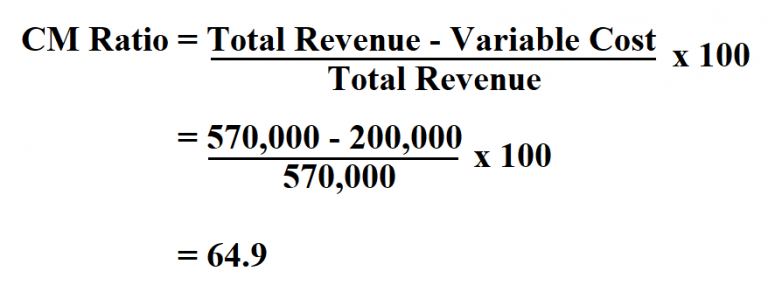

As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making. In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit. You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved. The Contribution Margin Ratio is a measure of profitability that indicates how much each sales dollar contributes to covering fixed costs and producing profits. It is calculated by dividing the contribution margin per unit by the selling price per unit.

Contribution Margin Per Unit Formula:

Total contribution margin (TCM) is calculated by subtracting total variable costs from total sales. When calculating the contribution margin, you only count the variable costs it takes to make a product. Gross profit margin includes all the costs you incur to make a sale, including both the variable costs and the fixed costs, like the cost of machinery or equipment. It appears that Beta would do well by emphasizing Line C in its product mix.

Our Services

Let’s look at an example of how to use the contribution margin ratio formula in practice. We’ll start with a simplified profit and loss statement for Company A. Once you calculate your contribution margin, you can determine whether one product or another is ultimately better for your bottom line.

Analysis and Interpretation

Profit is any money left over after all variable and fixed costs have been settled. It means there’s more money for covering fixed costs and contributing to profit. You can calculate the contribution margin by subtracting the direct variable costs from the sales revenue.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- After variable costs of a product are covered by sales, contribution margin begins to cover fixed costs.

- To calculate this figure, you start by looking at a traditional income statement and recategorizing all costs as fixed or variable.

- A negative contribution margin tends to indicate negative performance for a product or service, while a positive contribution margin indicates the inverse.

- She is a former CFO for fast-growing tech companies with Deloitte audit experience.

- The contribution margin ratio for the birdbath implies that, for every \(\$1\) generated by the sale of a Blue Jay Model, they have \(\$0.80\) that contributes to fixed costs and profit.

Our mission is to improve educational access and learning for everyone.

The analysis of the contribution margin facilitates a more in-depth, granular understanding of a company’s unit economics (and cost structure). A low margin typically means that the company, product line, or department isn’t that profitable. An increase like this will have rippling effects as production increases. Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future.

One of the most critical financial metrics to grasp is the contribution margin, which can help you determine how much money you’ll make by selling specific products or services. The overarching objective of calculating the contribution margin is to figure out how to improve operating efficiency by lowering each product’s variable costs, which collectively contributes to higher profitability. The Contribution Margin is the incremental profit earned on each unit of product sold, calculated by subtracting direct variable costs from revenue.

In our example, if the students sold \(100\) shirts, assuming an individual variable cost per shirt of \(\$10\), the total variable costs would be \(\$1,000\) (\(100 × \$10\)). If they sold \(250\) shirts, again assuming martin frauenlob an individual variable cost per shirt of \(\$10\), then the total variable costs would \(\$2,500 (250 × \$10)\). The contribution margin represents how much revenue remains after all variable costs have been paid.